I. Market Status: Structural Opportunities Emerge Amid Supply-Demand Tussle

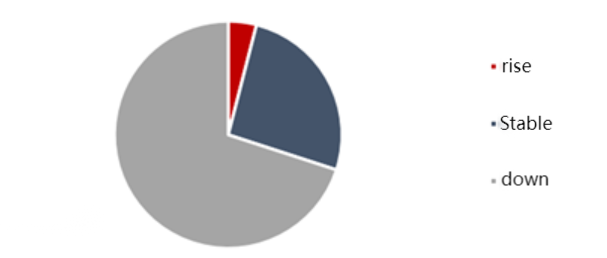

From the perspective of the overall market operation, the paraffin market in August was dominated by supply and demand, with a stalemate in trading atmosphere. The enthusiasm of terminal procurement was insufficient, and most of the activities were focused on digesting the previous inventory. The pressure on middlemen to sell off their stocks was obvious. Although the listed prices of refineries remained stable, there were cases of market transactions being at a discount. Entering September, although it is a traditional peak demand season and the supply side is tight due to refinery maintenance, the follow-up of terminal orders is weak, and the recovery of demand is limited. The feature of "peak season without prosperity" is prominent in the market.

In terms of price, the listed prices of paraffin wax from domestic major refineries were generally flexibly reduced in early September (except for Jingmen Petrochemical and Jinan Refining & Chemical), and the current prices are at the lowest level of the year. However, as the market's expectation of a stable outlook for the future heats up, coupled with the support from the supply side, the market is gradually entering a "stabilization after decline" operation stage, providing a relatively stable price window for export trade.

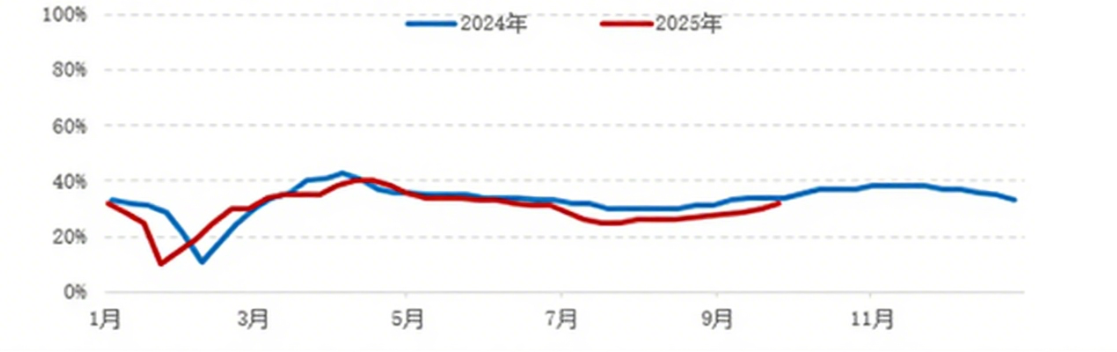

Statistics on the expected operating rates of downstream industries

II. Supply Side: Fushun's Local Advantage Ensures Stable Supply

The supply side is a crucial support for the current market. Domestic paraffin wax production capacity remains unchanged for the time being, but resource supply is significantly affected by refinery equipment maintenance and production cuts. Among them, Fushun Petrochemical has entered the maintenance and shutdown stage since August 15th, with a planned duration of about two months. This maintenance action directly impacts the supply pattern of the paraffin wax market - it is estimated that domestic paraffin wax production in September will be approximately 80,000 tons, a 20% decrease compared to the previous month and a 42.9% decrease compared to the same period last year. The monthly supply volume is significantly lower than the normal level (about 140,000 tons), and the tight supply situation in the market is clear.

As a local paraffin supplier in Fushun, we leverage the advantages of our location and maintain close cooperation with local refineries. This enables us to accurately grasp the production rhythm of the facilities. Against the backdrop of tight market supply, we provide continuous and reliable paraffin supply to global buyers with stable resource channels and sufficient inventory reserves, effectively avoiding supply risks brought about by market fluctuations.

MARKET SENTIMENT

III. Demand Side: Diversified Demand in Multiple Fields, Export Potential Worth Exploring

The downstream demand for paraffin wax covers multiple fields such as candles, boards, packaging, plastics, and tires and rubber. Currently, the demand in each field shows differentiation, and there is certain potential in the export market:

Candle Field: Domestic candle merchants are mostly digesting their previous inventories, and their enthusiasm for stockpiling is generally low. However, according to customs data, the export volume of candles reached 210,000 tons from January to July, with a cumulative year-on-year increase of 4.93%, and the growth in exports is mainly concentrated in the European and American markets. Although the EU's imposition of anti-dumping duties on candles from China has brought some pressure, there is still considerable room for breakthroughs by optimizing product structures and expanding into other overseas markets.

Tires and Rubber Field**: In the all-steel tire market, under the normal operation of the freight market, the high temperature accelerates tire wear, slightly increasing the intention to replace tires, which promotes the circulation of goods in the tire trading sector and indirectly supports the demand for paraffin wax.

Plastic (PE Pipe) Field**: Due to the slow recovery of the real estate industry and the impact of hot and rainy weather on construction site operations, the demand for PE pipes is relatively weak, and downstream plate factories have limited orders, which has a certain drag on the demand for paraffin wax.

Overall, the increase in the operating load of downstream factories is limited. Merchants mainly make purchases based on their actual needs. However, some growth highlights in the export market have provided new cooperation directions for paraffin suppliers. By conducting in-depth research on the demand characteristics of various downstream fields, we can provide customized paraffin product solutions based on the market demands of different countries and regions, meeting diverse procurement needs.

IV. Market Outlook for September: Stabilization after a Decline, Window of Opportunity for Export Cooperation Opens

Taking into account both supply and demand factors, the paraffin market in September will mainly feature a "stabilization after a decline":

Supply Support: Fushun Petrochemical will remain in the maintenance period in September, which is expected to reduce monthly production by approximately 50,000 tons. The operating load rate of the paraffin industry in September will drop to 52%, a decrease of 17 percentage points compared to August. The tight supply situation will continue to provide support for prices.

Demand Outlook: Although the downstream demand is transitioning from the traditional off-season to the peak season and the digestion of previous inventories is advancing, easing the supply-demand contradiction, factors such as the sluggish recovery of the real estate industry and the uncertainty of international trade tariffs still restrict the demand's pull on prices. The overall market demand recovery will still take time.

Price Trend: After the listing price was adjusted downward due to oversupply at the beginning of September, the subsequent listing prices of refineries will mainly stabilize. Market transactions will be mainly based on negotiations, and the price movement will be relatively stable, creating favorable conditions for cost calculation and order signing in export trade.

V. Choose Us: Professional Suppliers in Fushun, Helping You Expand into the Global Market

As a seasoned local supplier of paraffin wax in Fushun, we have three core advantages that provide global buyers with a superior cooperative experience:

1. Advantage of Direct Supply from the Source: Rooted in Fushun and close to core refineries, we can obtain high-quality paraffin wax resources in the first instance, shorten the supply chain, reduce procurement costs, and ensure supply efficiency.

2. Market Insight Capability: We continuously track global paraffin wax market dynamics, deeply analyze supply and demand trends, price movements, and changes in downstream demand, providing customers with professional market consultation and procurement advice to help them avoid market risks and seize profit opportunities.

3. Customized Service Capability: In response to the market demands and industry standards of different countries and regions, we can offer paraffin wax products of various specifications and qualities, and provide flexible delivery methods and comprehensive after-sales services to meet customers' personalized procurement needs.

Currently, the paraffin market is at a crucial stage of "stabilizing after a decline", and the window of opportunity for export cooperation has arrived. If you are a global paraffin purchaser or a company interested in expanding paraffin-related business, we welcome you to contact us to jointly explore cooperation opportunities and jointly develop the global market!

[Click to Consult] Learn more about paraffin products details and cooperation plans

[Contact Us] Get exclusive purchase quotations and market analysis reports